Small 2023 gap, HUGE Q4 advantage

Of course, it’s definitely not unusual for iPhones to prove a lot more popular than handsets from any other manufacturer in any given year’s holiday season, but even by those standards, Apple’s Q4 2023 lead over Samsung, as well as Xiaomi, Transsion, and Vivo, was mind-blowingly large.

In Q4 2022, for instance, Apple “only” surpassed the shipment figures of its biggest rival by 12.6 million units, holding a market share advantage of a little over 4 percent that wasn’t enough to dethrone Samsung when the year’s total numbers were tallied.

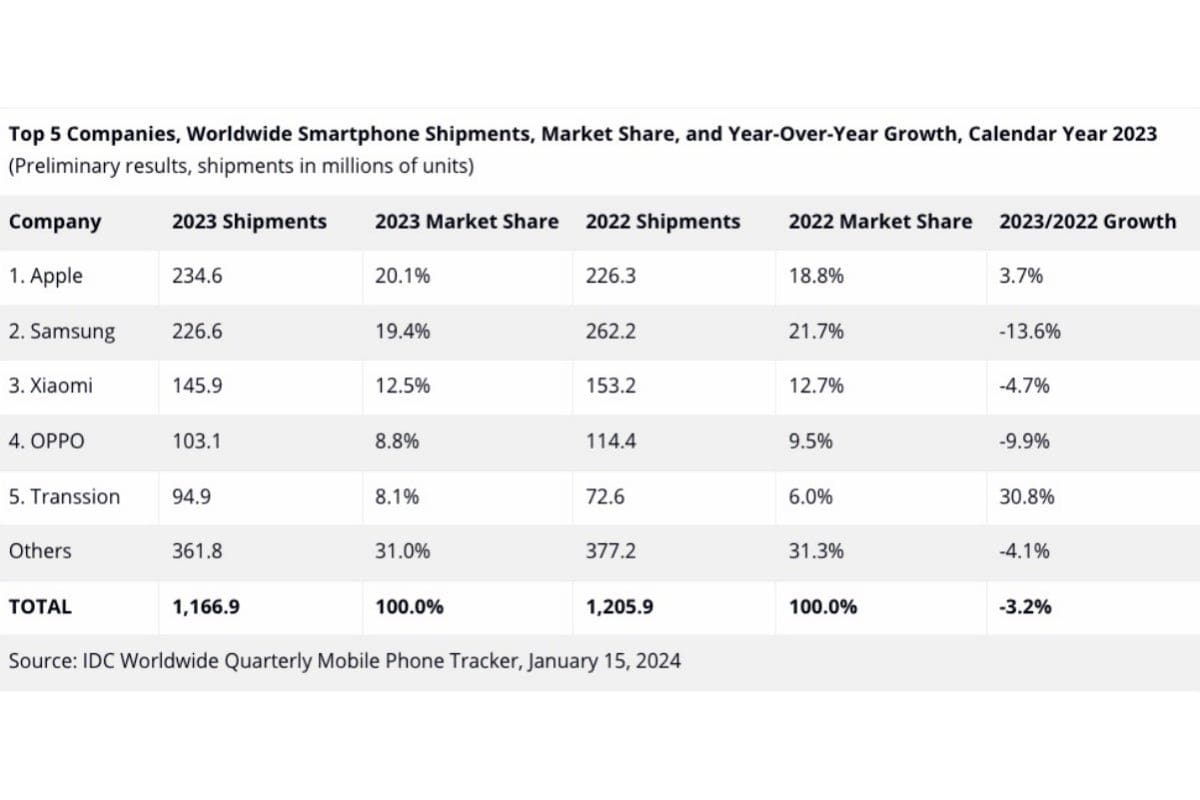

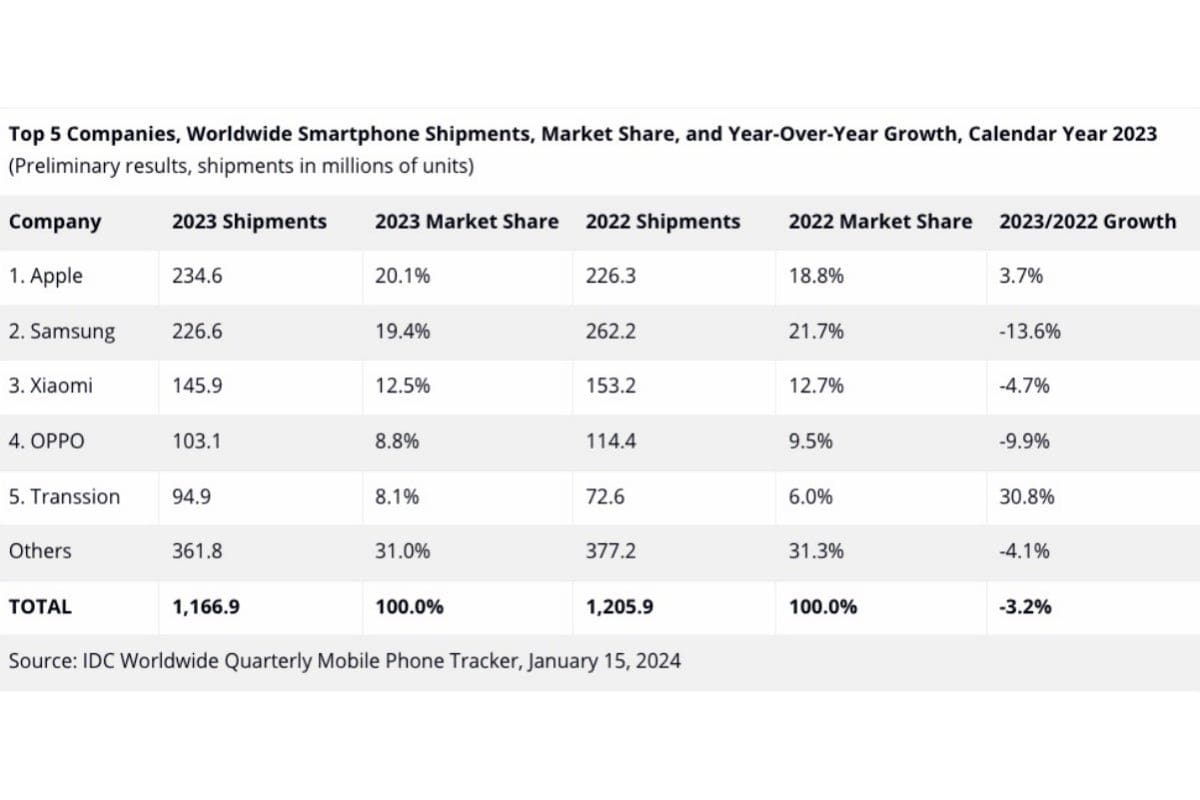

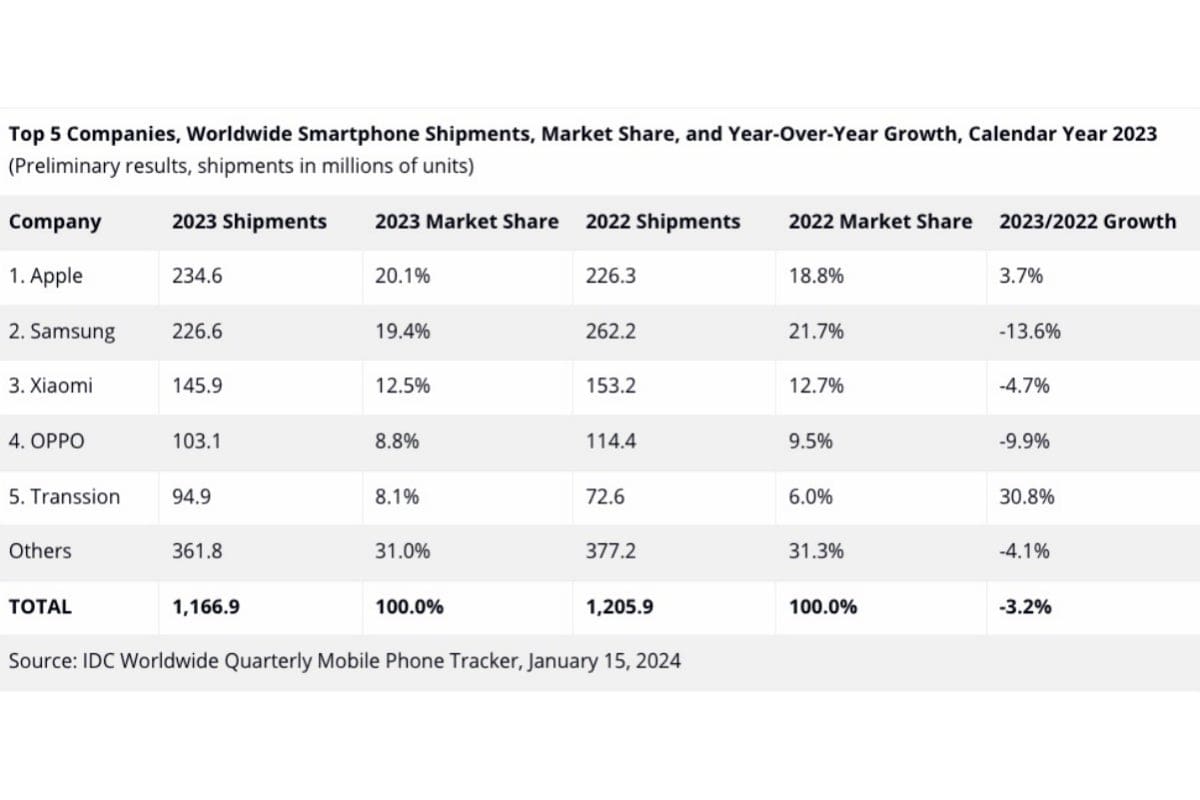

Things were evidently different in 2023, but as much as Apple outdid itself to finish a challenging year for the smartphone market as a whole with a 3.7 percent higher sales score than the one posted in 2022, it was primarily Samsung’s poor performance that made this major change in hierarchy possible.

Market growth IS around the corner

Although no one can really predict the future with anything remotely resembling a solid degree of certainty, this is roughly the one hundredth (no, not really) report put together by a reputable market research firm that anticipates an imminent recovery for the long-struggling smartphone world.

What’s perhaps more important is that said recovery has actually already begun in Q4 2023, when global smartphone shipments went up a healthy 8.5 percent from the same period of the previous year, and now all that the world’s top vendors need to do is keep this new trend going into 2024.